Whilst the Coronavirus is taking the spotlight, the new tax year is fast approaching, and with it comes updated employment rates

From 1 April 2020, the following change will come into effect:

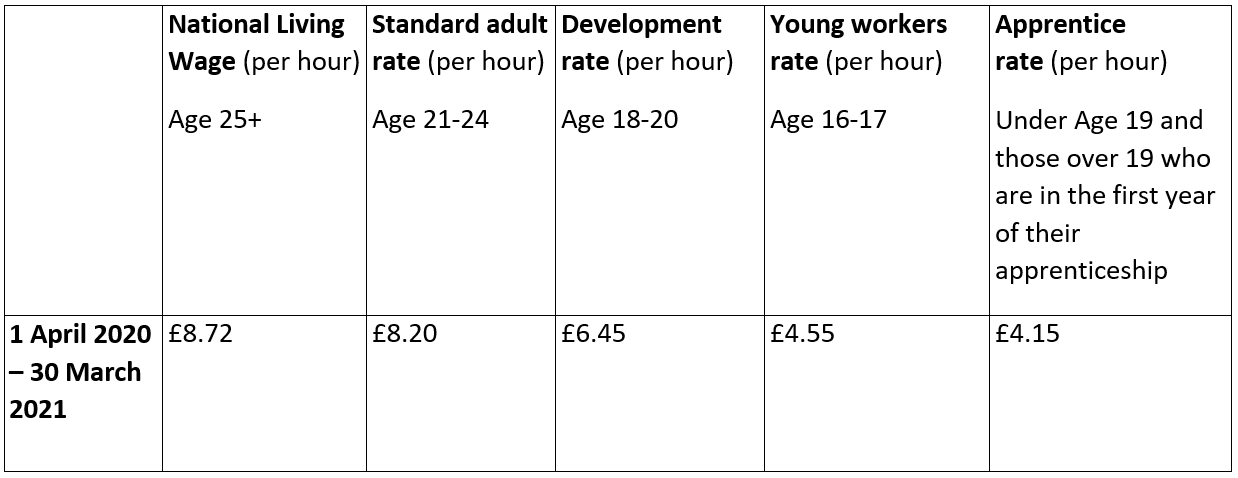

- National Minimum Wage

The rates will be increased as follows:

From 5 April 2020 the following changes will come into effect:

- Statutory Maternity and Paternity Pay, Statutory Shared Parental Leave Pay and Statutory Adoption Pay

The rates of statutory maternity pay, statutory paternity pay and statutory shared parental pay and statutory adoption pay will increase from £148.68 to £151.20 (or 90% of the employee’s average weekly earnings if this figure is less than the statutory rate).

From 6 April 2020 the following changes will come into effect:

- Statutory Week’s Pay

The maximum amount of a week’s pay for the purposes of calculating statutory redundancy payments and the basic award in unfair dismissal claims will increase from £525 to £538.

- Maximum Basic Award for Unfair Dismissal and Statutory Redundancy Payments

The maximum amount for a basic award for unfair dismissal and statutory redundancy will be increased to £16,140 (30 weeks’ pay subject to the limit on a week’s pay).

- Maximum Compensatory Award

The maximum compensatory award for unfair dismissal will be increased to £88,519 (or 52 weeks’ pay if lower).

- Statutory Sick Pay

A weeks Statutory Sick Pay will increase from £94.25 to £95.85.

For more information on any of the above changes please contact a member of the Employment Team.